Know Your Customer (KYC) regulations add identity checks to banks’ customer on-boarding processes. The KYC process is not fully automated, so it adds to bank employees’ casework, making it one more thing to manage. This post explains the basic process model and highlights key benefits of using Signavio Workflow to manage a KYC process.

Know Your Customer process model

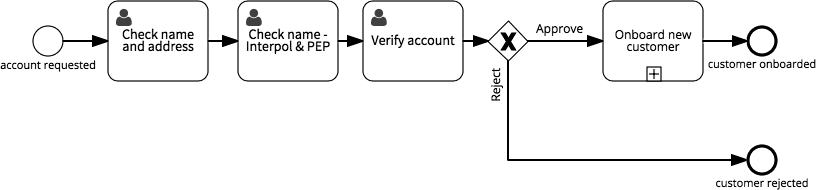

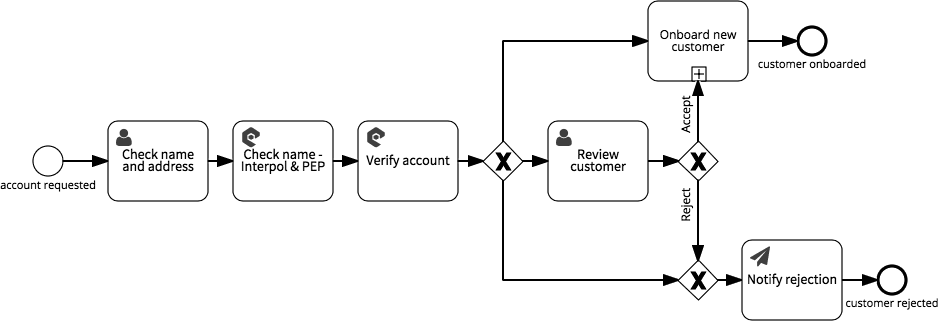

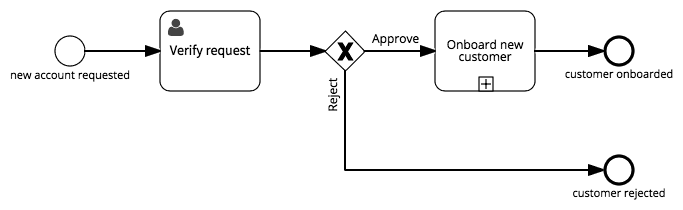

A Know Your Customer process consists of a number of customer identity checks that precede a decision to approve a new customer and start the on-boarding process.

This example uses a manual approval, with a ‘Verify request’ user task that requires a manual Approve or Reject decision. In practice, a KYC process includes more checks.

- Validate name & address - check customer identity.

- Validate name for Interpol & PEP - check the name against lists of known people.

- Calculate the customer’s risk of being involved in illegal activity.

These checks add user tasks to the start of the process, before the approval decision.

In practice, you would automate some or all of these checks, changing user tasks to script tasks. The exclusive gateway then changes from a manual decision to an automatic one. You could also add a manual ‘Review customer’ task in case the automatic check was not conclusive.

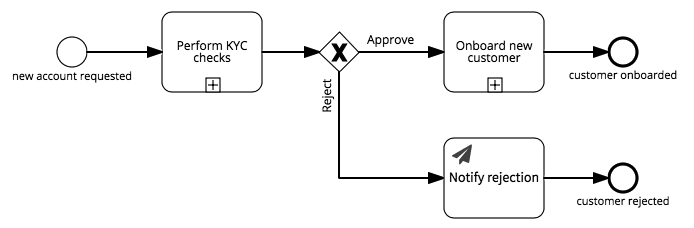

This version of the process model makes one more addition: the ‘Notify rejection’ task adds the rejection notification pattern to the model. An automatic notification informs the would-be customer without any delay.

Finally, as explained in Building custom activity types using sub-processes, you can extract the Know Your Customer checks into a sub-process to delegate the process model ownership to the fraud department.

From a process modeling perspective, this remains a simple example. The benefit of using Signavio Workflow comes not from understanding a complex process, but from executing it.

Benefits of Know Your Customer workflow execution

Performing this kind of business process manually tends to lead to inconsistent execution, task handover delays and poor visibility of work in progress. Executing a KYC process using Signavio Workflow delivers several benefits.

- Signavio Workflow’s cases view makes work in progress visible, so management updates don’t interrupt work.

- Signavio Workflow automatically records and stores the results of process execution, making process execution verifiable.

- KYC checks are less likely to be skipped during customer on-boarding, improving process quality.

- Each case continues automatically after KYC checks are not complete, avoiding delays in handovers between departments, and reducing on-boarding time.

- The process model is flexible, so you can update it as KYC requirements change.

These benefits represent extremely valuable improvements in the quality of the process result.. As with other banking processes, it's essential to perform KYC checks efficiently and correctly.

Whatever business you’re in, try Signavio Workflow for your own customer on-boarding process. To get started, sign up for a free trial.