How to navigate your economic transformation?

Process thinking in the insurance sector is changing

The insurance sector is subject to constant change: customer demands, laws and guidelines – these things are in a constant state of flux. In a previous blogpost (Process Thinking in European Insurance) on this topic we had a look at how the Process Thinking of European insurers has changed as a result of Digital Transformation and market developments. With an end-to-end look at own processes and a targeted optimization of working processes, insurers are reacting to these challenges and asserting themselves in a highly competitive market.

There have been comparable developments in other markets in the sector as well, so we don’t want to limit this post to the European market, it’s universally applicable. Change dominates the economy and you can only keep up if you focus your energy on the core of your organization: your business processes and decisions.

Performance gain despite changing compliance stipulations

When it comes to application reviews, claim settlements or determining tariffs: Risk Management plays a significant role in insurance processes. Due to the Minimum Requirements for Risk Management legislation, German insurers are required to document their processes and to identify risks through an internal controlling system. Software-based Process Management is therefore fundamental for Quality Management and controlling and secures compliance. Additionally, if implemented well, it can also lead to improved performance.

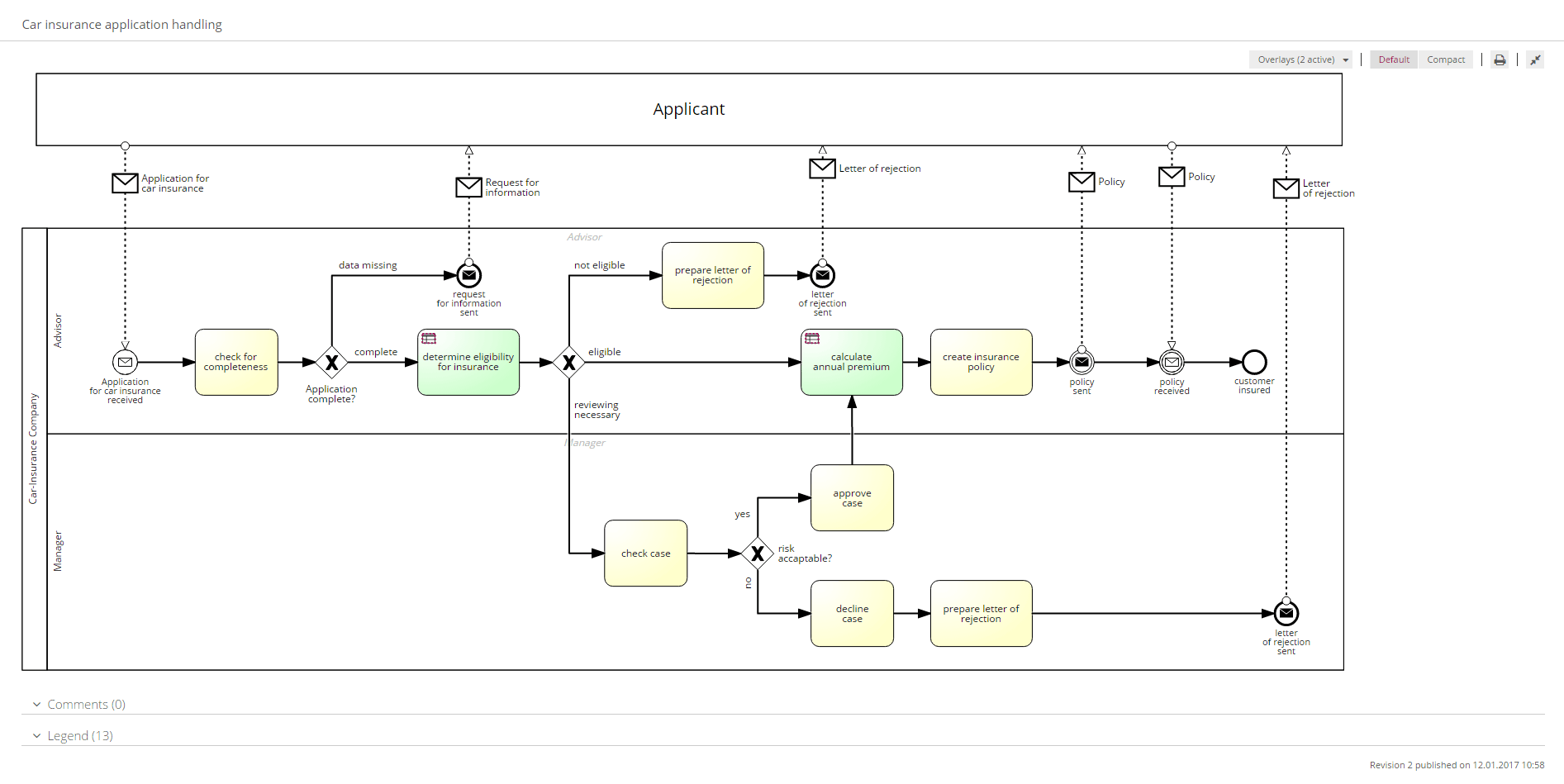

Let’s have a look at a typical insurance process:

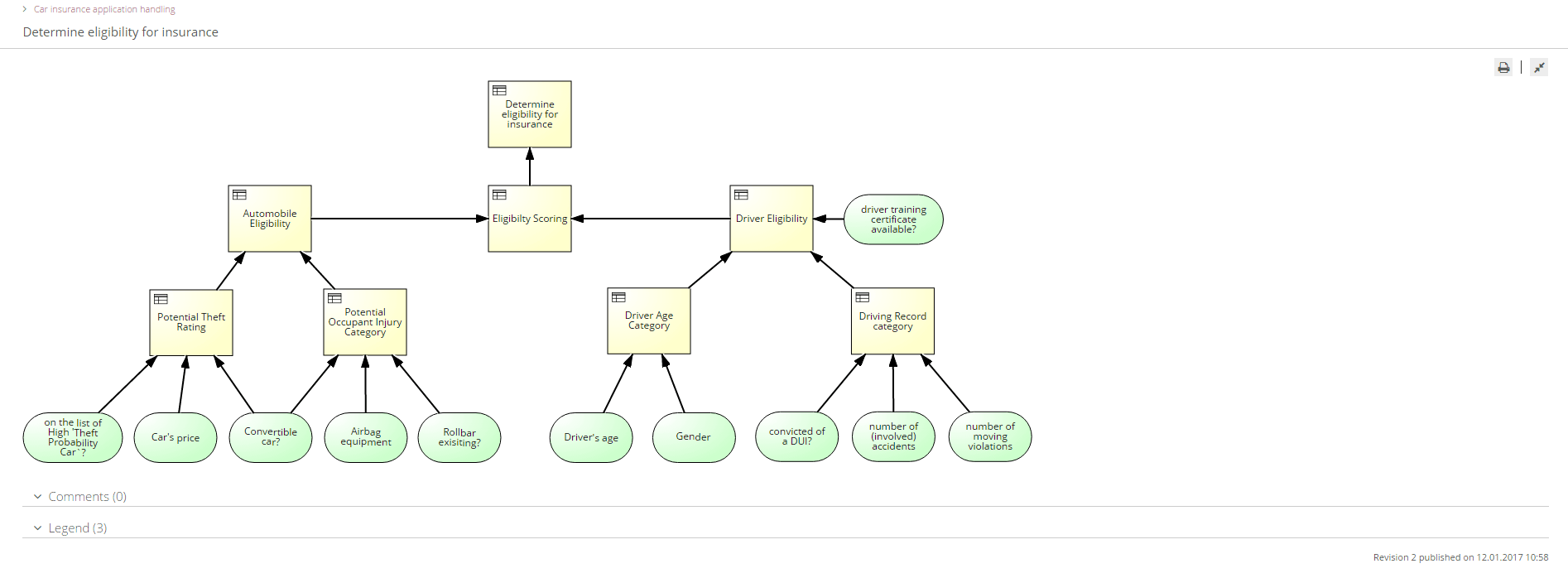

This example deals with the correct processing of a car insurance claim. Through its presentation in BPMN 2.0, the responsibilities, tasks and necessary documents are easily recognisable. After the documents have been checked and are complete, the employee responsible for the case must check the insurability of the claimant. It goes without saying that the employee cannot act based on their own judgement, but must comply with prescribed rules when making a decision. This is why the relevant task is marked as a Rule Task in our process diagram. In a decision diagram below this process, the responsible employee can recognize all input-data and see how they should act in a variety of cases:

Due to the fact that the decisive questions are shown directly, employees don’t have to consult complex sets of rules and get all the information they need on one platform. The case can therefore be processed relatively quickly and in a uniform and compliant way. As soon as requirements change they can be quickly added into the decision logic, so that everyone is led to a consistent and optimal decision.

Bringing Process and Decision Management together

Insurance processes contain operative business decisions. It’s therefore a useful approach to manage both on the one platform. Not only does this make transparent documentation possible, but also:

- working to uniform standards

- complying with regulations

- quick documentation and implementation of legislative changes

- reacting to a constantly changing market

The economy has significantly picked up the pace. Modern Process Thinking doesn’t only require that insurers focus on processes and decisions but also that they have the courage to change and manage themselves dynamically. A software-based management system makes it possible to constantly adjust processes and decisions and to act them out. In this way, you can confidently meet the challenges of economic transformation and will always be a step ahead of the competition.

Get fit for the future with our knowledge resources!

We want to help you on your way to professional business transformation management as best as possible. You can find a selection of free and informative white papers on our website, which are particularly interesting to the insurance sector at the moment. For example:

The Blueprint for Modern Compliance Programs An Introduction to Business Decision Management Modeling a Successful Future for British Insurance with Signavio

You can also register at any time for a free 30 day test version or request a personalized web demo at info@signavio.com. You can also benefit from the experiences of Signavio customers, such as the pension fund Verka VK.

Our journey through the process world of the insurance sector will continue! Look forward to an interview with Norbert Sandau of the AOK Nordost – coming soon exclusively in our blog!

If you don’t want to miss an interview or article from Signavio, then register for our fortnightly Newsletter! Here you’ll see everything that’s new at Signavio.