Process goal

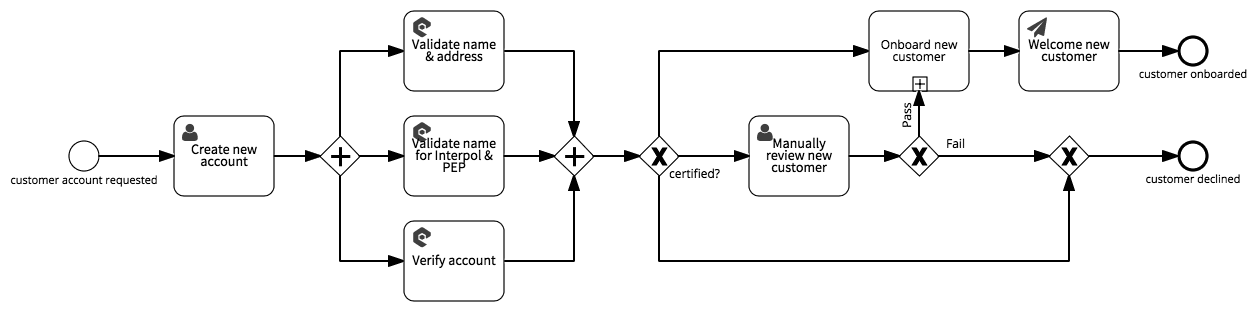

Onboard a new customer in compliance with Know Your Customer (KYC) regulations.

Context

Know Your Customer (KYC) regulations add identity checks to banks’ customer onboarding processes. The KYC process is not fully automated, so it adds to bank employees’ casework, making it one more thing to manage.

Trigger

Form - the customer’s application for a bank account.

Actions

After the initial data capture, this workflow first creates parallel tasks for the KYC checks that verify the customer’s identity. The next step is a triage decision that in either accepting or rejecting the application, or manual review.

The result of a successful application is a separate onboarding sub-process, and a success notification email.

Roles

- Branch employee - does the initial data entry for the application.

- Bank manager - reviews cases where the identity check results are uncertain.

Fields

This workflow uses two groups of fields. The first identifies the customer - name, address, date of birth, etc.

The second group of fields captures the results of the KYC checks, which are used by the automatic decision that performs triage depending on whether the customer is certified.