Cutting-edge technology and improved finance processes

According to a recent survey report of 300 finance leaders (Repositioning for Growth, SAP SE, 2024), 63% of respondents are actively investing in cutting-edge technology to enhance their ability to react to changing circumstances, up from 33% in 2023. And many seem to have issues like cost control, with 73% reporting inaccurate forecasting and 62% unable to reliably predict future price rises.

As outlined below, process issues are often at the root of many finance-related challenges. And with that, let's explore the top 4 challenges for finance leaders—and the ways SAP Signavio solutions can help, accelerating the path to financial excellence and financial management improvement.

Eager to learn more?

- Read the latest white paper: How finance leaders can maximize financial excellence and efficiency

- Join the upcoming webcast about CRH’s transformational finance journey towards process excellence

Top 4 challenges for finance leaders—and the ways SAP Signavio solutions can help

1. The data challenge: Lacking appropriate and integrated data made available across functions

To navigate disruptive events, finance functions need a dynamic, data-driven, event-based mirror of their end-to-end financial landscape so they can fully understand what’s happening, run what-if scenarios, and make precise decisions that can achieve the best business outcomes.

Traditional finance systems can often fall short as they typically provide fragmented, static data, so it is more difficult to capture the full financial lifecycle of records, products, services, and financial transactional items (such as invoices and payments). This can leave finance leaders with gaps in understanding where they most need to lead, for example maximizing the top line.

Imagine, for example, that escalating tariffs trigger a sudden global financial collapse. How will you ensure your business, which manufactures goods all over the world, cuts costs so you don’t burn through cash flow too quickly?

Top 4 challenges for finance leaders - How SAP Signavio can help

SAP Signavio solutions can not only help you identify where to integrate data and processes, but they can help you create a digital financial twin that aggregates and standardizes your financial data and processes for financial analysis purposes. This can help you:

- Identify performance drivers and opportunities for improvement by drilling into individual items such as invoices and payments

- Simulate process variants and optimize resource allocations

- Identify process improvement and innovation opportunities

To return to the “reduce cash burn” scenario above, this means you can simulate your company digitally, and run root cause analyses to identify where your cash management leaks related to process inefficiencies may be. You can also run cost-savings scenarios to identify levers of control—and decide, for example, which processes may be worth standardizing, how much cash discounts you're missing, and what may impact your financial 'straight through' processing and the bottom line.

2. The IT systems challenge: Having applications perceived as a business impediment instead of a business value driver

Traditional finance systems can also often lack the agility, in-depth visibility, and comprehensive process capabilities to help finance teams manage large, complex projects and renewable contracts. Whether it’s a massive IT upgrade, the construction of a new building, an acquisition, processing times, or long-term services agreement, CFOs take care of issues regarding poorly handled duplicate payments, suboptimal financial reporting, and increased risk exposure, especially in collaboration with internal and external audits.

Why? Because traditional finance systems can lack the agility, in-depth visibility, and end-to-end process capabilities to manage such complexity.

Top 4 challenges for finance leaders - How SAP Signavio can help

SAP Signavio solutions can help by providing AI in finance with process-oriented, AI-infused, data-driven insights that help you enhance financial operations, mitigate risks, and operationalize robust financial governance. Support for process analysis integrations enable you to:

- Connect to external systems to pull diverse data sets, enriching process intelligence

- Access a broader range of process data for decision-making and planning

- Gain comprehensive process insights and transparency to identify improvement areas

- Scale financial processes and integrate new capabilities rather than overhaul systems

Through targeted integrations and process transformation improvements, you can gain improved project-to-cash process visibility and better finance control—all the way to the work breakdown structure, budget, and progress reports. This enables you to closely track and benchmark project costs, stay in budget, cut cycle times, prevent fraud, reduce bad debt, proactively manage contract renewals, and more.

3. The process challenge: Walking the business transformation talk

To keep businesses competitive, agile, and resilient, finance leaders are striving to drive broader financial transformation. But many lack the advanced tooling to navigate, analyze, and determine the best way to transform and optimize their financial data and processes. The result can be lots of time and effort, but little action.

Top 4 challenges for finance leaders - How SAP Signavio can help

SAP Signavio solutions provide the process excellence, transformation capabilities, and tools needed to drive holistic finance transformation at scale. Using timely access to accurate, consolidated dashboards, reports, data, and process insights, you can overcome complexity and uncertainty and make faster, data-driven decisions on how to streamline and optimize operations. For example, you can:

- Combine process AI technology, process best practices, and built-in finance metrics and benchmarks to identify improvement areas and accelerate time to value

- Foster financial compliance and sustainability through process governance, process standardization, and finance automation

- Quickly improve processes in ways that maximize performance, control costs and spend management, and reduce risk with built-in simulation capabilities and prebuilt content.

4. The combining factor challenge: Achieving holistic business transformation

Finance teams can also often work in silos using disconnected processes, leading to fragmented data and inefficient operations. When data is spread across multiple platforms, employees lack a unified view of what’s really happening and why. This, combined with manual processes, makes it harder to quickly adapt to market changes, navigate uncertainty, and safely balance costs and profitability.

Top 4 challenges for finance leaders - How SAP Signavio can help

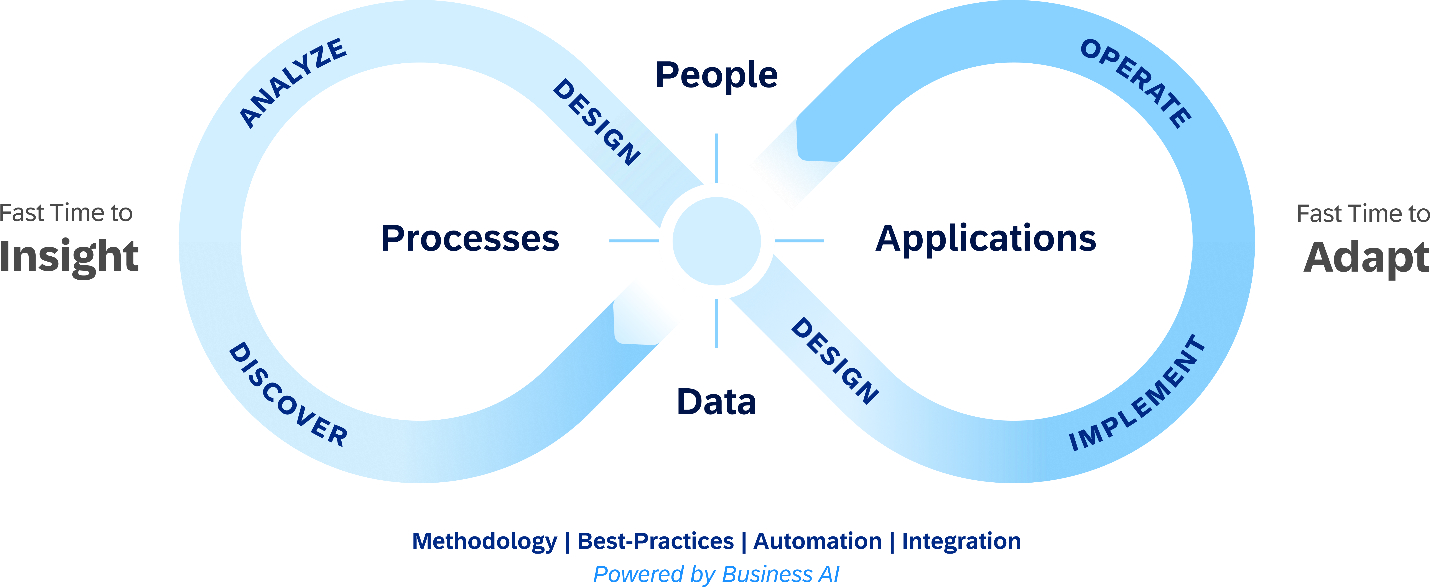

As shown in the figure below, the transformative approach of SAP Signavio keeps people, processes, data, and applications at the center of driving continuous AI-assisted improvement within financial lines of business. For example, the solutions support collaboration within and outside your organization to help ensure key stakeholders are aligned and educated about process changes and integrations.

This way, you can streamline financial control and operations, and benefit from faster time to insights needed to better understand the performance of your finance processes, which areas need attention, and how you can resolve issues. You can also adapt finance operations faster, which makes your business more resilient in turbulent conditions.

A virtuous cycle of continuous process improvement

Want to learn more about how SAP Signavio solutions can help your organization? Download the paper: How finance leaders can maximize financial excellence and efficiency: Transforming processes to boost revenue, profitability, and financial control at scale.