Process Mining

Process mining is a data-driven methodology that reconstructs and analyzes how business processes actually run by extracting event logs from IT systems.

Process mining is a data-driven methodology that reconstructs and analyzes how business processes actually run by extracting event logs from IT systems.

Organizations often design processes with the best intentions—documenting how work should happen across finance, supply chain, customer service, or IT. But in reality, everyday execution often looks very different. Hidden workarounds, manual steps, or system variations can quietly erode efficiency and compliance.

This is where process mining comes in. Within business process management, it provides a fact-based way to uncover the true “as-is” process, making it one of the most powerful approaches to process discovery. Rather than relying only on workshops or interviews, it uses digital footprints from enterprise systems to show how processes actually run at scale.

Viewed from this higher level, process mining acts as the bridge between design and reality—helping organizations ground their improvement efforts in evidence and build confidence that change will deliver measurable results.

Process mining bridges the gap between traditional process documentation and real-world execution. While process models often describe how work is intended to happen, process mining shows how it actually happens by analyzing digital footprints left in enterprise systems such as ERP, CRM, or workflow platforms.

At its core, process mining:

Unlike manual workshops or interviews, process mining scales across thousands of transactions and multiple systems, giving an objective view of process performance.

This makes it an essential enabler for initiatives like ERP transformations, compliance audits, and automation programs.

Process mining has three primary use cases:

→ Related: Business Process Management vs Analysis vs Automation

Process mining works by turning raw system data into meaningful process insights. Many enterprise systems—such as ERP, CRM, or IT service platforms—record transactions as event logs. If a system does not produce logs directly, data must first be extracted and prepared to be usable for process mining.

At a minimum, an event log needs three elements:

Additional attributes (such as user, department, or cost center) can enrich the analysis, but without the three core elements, process mining cannot be performed. By combining these elements across thousands or millions of cases, process mining tools can reconstruct the end-to-end flow of each process instance.The aggregated view reveals:

The results are usually visualized as interactive process maps, where paths can be filtered by department, geography, system, or performance metric. This allows teams to drill down from a high-level overview into specific problem areas.

Modern process mining platforms often integrate with task mining, which captures user interactions on the desktop, and with AI features that make insights easier to access, improve adoption, and in some cases predict risks or recommend improvements.

Process mining can be applied in different ways depending on the organization’s goals and data maturity. The three main types are:

Process discovery is the most common starting point. Event log data is used to automatically generate a visual model of the process as it actually runs, without relying on manual workshops or outdated documentation.

Compares real-world event logs against a predefined process model (e.g., a compliance framework or “to-be” design).

Extends existing models with performance data such as throughput times, waiting periods, or error rates.

Together, these approaches allow organizations to move from “what’s happening” (discovery) to “is it happening as it should” (conformance) to “how well is it happening” (enhancement).

Process mining sits alongside several familiar methods. The key difference: it reconstructs end‑to‑end flows from event data (who did what, in which system, and when). The approaches below can complement it—use the right mix based on your goal, data quality, and maturity.

Process mapping creates a visual representation of how stakeholders believe work is done, while process mining shows how it actually happens based on system data. Together, they bridge perception with reality.

Although they sound similar, these methods serve different purposes. Data mining looks for patterns across any dataset, while process mining focuses exclusively on processes.

Task mining and process mining are complementary. Task mining looks at the micro-level—how employees complete tasks on their desktops—while process mining examines the macro-level flow across systems.

Business intelligence tools provide performance dashboards, while process mining explains the processes behind those metrics. BI answers “what happened,” and process mining answers “why.”

Organizations can approach process mining in stages depending on their maturity. If reliable event data isn’t yet available, it makes sense to begin with manual process mapping and light business intelligence, then introduce mining as systems and logs become richer.

For companies already tracking KPIs but struggling to understand why performance lags, process mining adds the missing layer—exposing the actual paths, process variants, and points where work stalls.

And for those with scattered RPA bots or workflow automations, mining brings the end-to-end picture back together, showing how human and automated steps interact across systems.

| Approach | What it is | Best for | How it pairs with process mining |

|---|---|---|---|

| Process mapping | Workshop- or interview-based diagrams of how work should flow. | Early discovery, low-system processes, communicating a target model. | Use mining to validate maps, quantify timings, and reveal hidden variants. |

| Task mining | Desktop-level capture of user clicks/keystrokes. | Human-in-the-loop tasks, UI-level friction, SOP standardization. | Combine with mining for “micro-to-macro” insight: task details + end-to-end flow. |

| Business intelligence (BI) | Reports and dashboards of KPIs/aggregates. | Tracking outcomes (e.g., on-time delivery, spend). | BI shows what; mining shows how/why via paths, variants, and rework. |

| Data mining / advanced analytics | Pattern detection, prediction, clustering on datasets. | Forecasting risk, classification (e.g., late orders). | Use mining to create process-aware features; use ML to predict next-best action. See also: [Process mining vs data mining]. |

| Workflow / RPA logs | Status and audit trails inside a single tool or bot. | Monitoring a specific automated flow. | Mining unifies across many systems (ERP/CRM/ITSM + bots) to spot cross-system bottlenecks. |

| Value stream mapping (Lean) | Workshop-based map of value-adding vs. waste. | Lean initiatives, cycle-time reduction. | Mining quantifies wait time, rework, and throughput to prioritize Lean improvements. |

| Audits & compliance reviews | Periodic sampling against policies. | Formal assurance and controls testing. | Mining provides continuous conformance checking between “should” and “is”. |

Process mining delivers value because it shifts improvement from assumption-based workshops to data-driven transparency. Instead of guessing how processes operate, organizations gain a fact-based view that scales across departments and systems.

By reconstructing the “as-is” process from event data, process mining eliminates blind spots. This creates a shared baseline across business and IT, helping teams align on reality rather than perceptions.

Conformance checking makes it possible to compare actual execution with intended rules and models. This is crucial in regulated industries like healthcare or finance, where fines or reputational risks can stem from even minor deviations.

Process enhancement reveals bottlenecks, delays, and rework loops that drive unnecessary cost. By quantifying cycle times and resource usage, organizations can prioritize the highest-value improvements.

Use cases often extend beyond compliance and cost. For example, in insurance, mining claims-handling processes can reduce wait times for customers. In HR, analyzing onboarding processes helps remove unnecessary steps that frustrate new hires.

By continuously monitoring process performance, organizations can adapt quickly to change. Whether scaling up a new product, adjusting to supply chain disruptions, or meeting new compliance requirements, process mining provides the agility to pivot without losing control.

Process mining is applied across industries and functions to bring hidden inefficiencies to light, strengthen compliance, and accelerate transformation.

The following examples from SAP Signavio customer cases and resources highlight its versatility:

In finance, process mining helps streamline invoice and payment cycles and is a core part of financial excellence process solutions.

This visibility is especially critical in highly regulated sectors such as banking and financial services, where compliance, auditability, and efficiency are closely linked.

Procurement teams use process mining to tighten control and reduce costs. Many initiatives are framed under procurement excellence process solutions to enforce compliance and improve supplier collaboration.

Connecting internal workflows to customer journeys highlights where inefficiencies impact CX, often forming part of broader continuous improvement programs.

End-to-end transparency across supply networks helps balance cost, speed, and quality. This visibility is central to transformation efforts such as ERP transformation process solutions.

IT and risk teams use process mining to ensure systems run in line with governance and regulations. This supports risk & compliance process solutions and regulations like the Digital Operational Resilience Act (DORA).

These improvements depend not only on the technology but also on the people driving it. Clear responsibilities across business and IT, such as those outlined in process mining project roles, are essential to realizing the full value.

And for organizations under pressure to adapt quickly, process mining also supports operational resilience by enabling faster responses to risks and disruptions.

Technology is what makes process mining practical at scale. While traditional mapping relies on workshops and interviews, process mining software extracts digital footprints from ERP, CRM, and workflow systems.

These tools reconstruct how processes actually run, visualize performance, detect deviations, and provide the insights needed for optimization.

Process mining software connect directly to enterprise systems, capture event logs, and transform them into end-to-end process maps. They allow organizations to identify inefficiencies, track KPIs in real time, and compare actual execution against intended workflows.

Without such tools, process mining is limited to isolated pilots rather than enterprise-wide transformation.

Advanced platforms extend capabilities with conformance checking, root cause analysis, and in some cases AI features that highlight anomalies or suggest which processes may be strong candidates for automation or further improvement.

When choosing process mining software, organizations should consider:

While process mining delivers transparency and measurable insights, organizations frequently face recurring challenges during initiatives. These pitfalls can slow adoption or reduce trust in results if not carefully addressed.

One of the most common hurdles is preparing reliable event logs from multiple IT systems. Inconsistent data sources, missing timestamps, or poor system documentation can delay projects.

For example, in procure-to-pay analysis, fragmented invoice data often makes it difficult to link purchase orders with actual payments, reducing confidence in the results.

Many organizations are surprised by how many deviations and workarounds exist compared to the “ideal” process. A single procurement process can involve late approvals, missing steps, or repeated corrections of invoices.

Without strong prioritization, teams risk drowning in variants instead of focusing on the few that matter most.

Process mining reveals “what happens,” but interpreting why it happens requires collaboration. A midsized software company, for example, failed to progress by only interviewing process owners.

When they used SAP Signavio Process Intelligence, they uncovered hidden process variations that reshaped workshops into more fact-based and productive discussions.

Leaders sometimes expect process mining to immediately cut costs or automate processes. In practice, it delivers visibility first.

Without managing expectations—such as by defining achievable goals like reducing process duration by 25% or harmonizing processes across two entities—initiatives risk losing executive support.

Even when insights are clear, teams may resist altering established workflows. Employees often see process mining as extra monitoring or control.

Success depends on pairing insights with strong communication, stakeholder buy-in, and governance practices.

Process mining succeeds when data quality is addressed early, insights are contextualized, and change management is built into the initiative. Organizations that view it not as a one-time project but as part of continuous improvement achieve sustained results.

The future of process mining goes beyond descriptive analysis. It is evolving into a discipline that predicts, prescribes, and even automates improvements in near real time.

Below are three trends that are shaping the next generation of process mining.

Artificial intelligence is transforming process mining from reactive reporting into proactive intelligence. Machine learning models are being used to detect anomalies, predict delays, and recommend corrective actions before issues escalate.

Instead of only showing why an invoice was delayed last month, predictive process mining can forecast when upcoming payments are at risk and suggest interventions.

These AI-powered insights help organizations move from hindsight to foresight, aligning process performance with strategic goals.

Process mining is becoming a key enabler of hyperautomation strategies. By revealing where the highest-value automation opportunities exist, it ensures that organizations focus their RPA, workflow, and low-code investments on areas with the biggest impact.

In parallel, the rise of digital twins of organizations (DTOs) is powered by process mining data. These digital representations of end-to-end operations allow leaders to simulate scenarios, test changes, and monitor performance in real time, creating a closed loop between design, execution, and optimization.

A final trend is the democratization of process mining. Once limited to data scientists and process experts, process mining tools are now being embedded into user-friendly platforms accessible to business users.

Citizen developers can use low-code/no-code environments to explore process data, design automations, and test improvements without depending on IT. This shift expands ownership of process excellence across the organization, making it a collective capability rather than a specialist function.

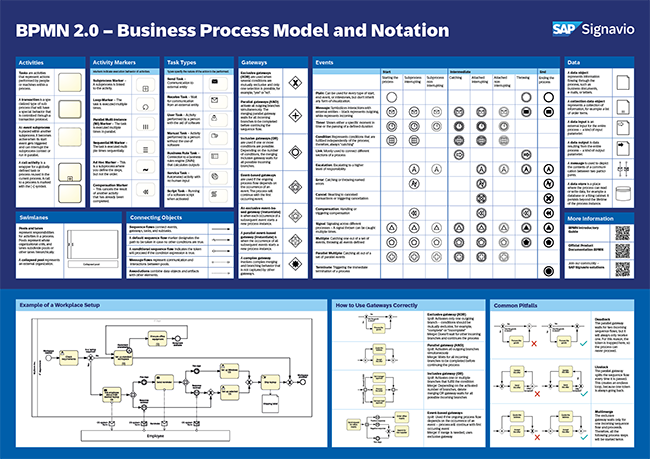

Get the most important standards, ready for you to modify and adapt according to your own standards and organizational needs.